Buying a Home in a Shifting Market and How To Do It!

Buying a home in a shifting market can be a daunting task, but it can also be a great opportunity for those willing to take the plunge. There are many perks to buying a home in a shifting market, including the potential for a great deal, the ability to negotiate with sellers, and the potential for long-term price appreciation.

One of the biggest perks of buying a home in a shifting market is the potential for a great deal. When the market is shifting, the prices of homes can be in flux, which means that buyers may be able to find a property that is priced below its true value. This can be a great opportunity to get a good deal on a home that may be worth more in the future.

Another perk of buying a home in a shifting market is the ability to negotiate with sellers. When the market is shifting, sellers may be more willing to negotiate on price, terms, and other factors in order to get their home sold. This can be a great opportunity for buyers to get a better deal on the home of their dreams.

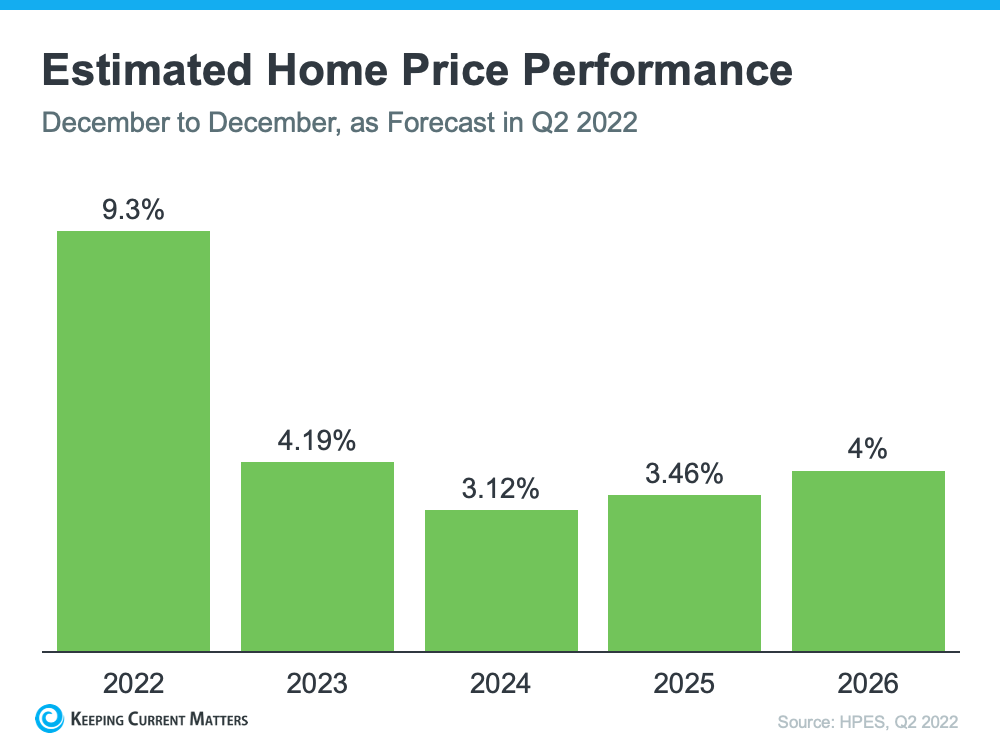

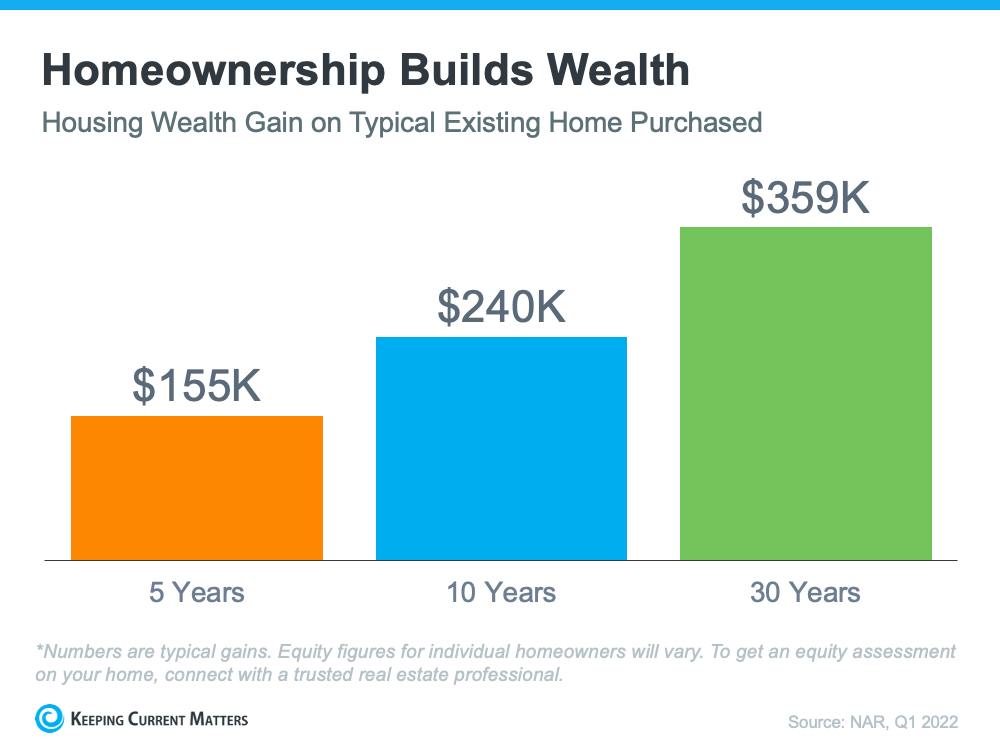

Finally, buying a home in a shifting market can also be a good opportunity for long-term price appreciation. Although the market may be shifting in the short-term, it is likely to stabilize in the long-term. This means that, over time, the value of your home is likely to increase, which can be a great way to build equity and wealth.

Now that we've discussed the perks of buying a home in a shifting market, let's take a look at the steps involved in the home:

- Determine your budget and get pre-approved for a mortgage: Before you start looking at properties, it's important to know how much you can afford to spend and to have a pre-approval letter from a lender. This will give you a better idea of what price range to focus on and will make you a more competitive buyer when it comes to making an offer on a property. We would be happy to introduce you to a reputable lender if you need.

- Get in contact with our office: Our team can help you navigate the home buying process and will have access to listings and information that you may not be able to find on your own. We will also provide valuable advice and guidance throughout the process.

- Start looking at properties: Once you have your budget and pre-approval letter in place, you can start looking at properties that fit your criteria. This may involve touring homes in person, attending open houses, and looking at listings online. Our team will also provide property alerts that are custom tailored to your specific search criteria.

- Make a list of must-haves and nice-to-haves: As you look at properties, it can be helpful to make a list of the features and amenities that are most important to you. This will help you prioritize what you're looking for and make it easier to compare properties.

- Research the neighborhood: In addition to looking at the properties themselves, it's also important to research the neighborhoods where you are considering buying. This will give you a better idea of the local schools, amenities, and overall quality of life in the area.

- Make an offer: Once you find a property you want to buy, you'll need to make an offer. This will typically involve putting down a deposit and submitting a written offer to the seller. As your agent, we will help you with this process and negotiate on your behalf.

- Get a home inspection: Before you finalize the purchase of a property, it's important to have a professional home inspection to identify any potential issues or defects with the property. This will help ensure that you are aware of any potential problems before you commit to buying the home. We will also work to negotiate any repair requests, or credits necessary to ensure you are happy with your

- Obtain homeowners insurance: Before closing on the purchase of a property, you'll also need to obtain homeowners insurance. This will protect your home and belongings in case of damage or loss, and will typically be required by your lender.

- Finalize the purchase: Once you have a clean home inspection report and have negotiated the terms of the sale, you can move forward with finalizing the purchase. This will involve signing a purchase agreement and other documents, and paying the remaining balance of the purchase price.

- Close the sale: The final step in the home buying process is closing the sale. This typically involves signing additional paperwork and paying closing costs, such as title and escrow fees. Once everything is in order, you will receive the keys to your new home and can begin the process of moving in.

If you have any questions about the information above, or any other questions about the real estate market, feel free to reach out. Our team is committed to providing the best possible experience when buying or selling a home.

Categories

Recent Posts